How to squeeze the rich

Jeremy Corbyn wants the rich to pay more tax?

His policy of punitive taxation will have exactly the opposite effect. But actually there is an intelligent way for a government which understands incentives to get more tax from the richest people. But you don't do it by confiscatory high tax rates - quite the opposite.

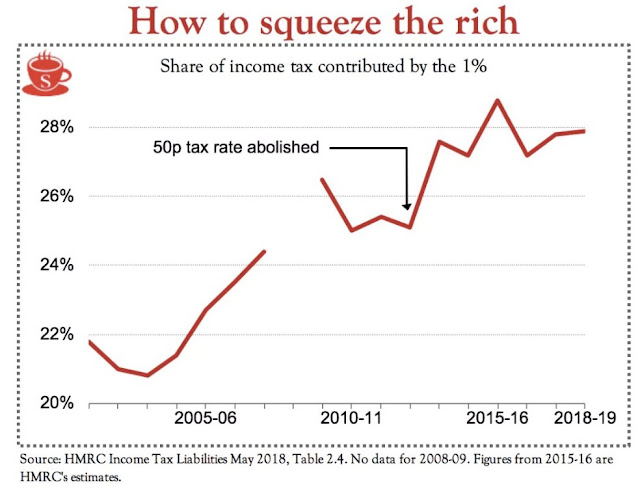

Grateful to Fraser Nelson of the Speccie for sharing this chart which shows how the share of income tax paid by the richest 1% in Britain has been trending up - and jumped up after the top rate was cut from 50%. The left hand part of the line is under the last Labour government, the right hand part is under the Coalition and then the Conservatives.

And the truth, contrary to just about everything said on the subject these days by even "moderate" Labour politicians, is that the rich have been paying more income tax, and a higher share of income tax under both David Cameron and Theresa May than they ever did under Blair and Brown.

So this is how an intelligent government might try to squeeze the rich.

Cut tax RATES from confiscatory levels and the AMOUNT of tax, and the proportion, paid by the richest 1% goes UP.

The same thing happened even more dramatically after 1979 when Maggie cut the top rate from 98% (on so-called "unearned" income, and 83% on "earned" income) to 60% (and later to 40%).

It's not rocket science. If people can keep more than 50% of extra money they earn, they've got more incentive to increase their after-tax income by increasing the amount of wealth they create. But if people are paying half or more of every extra pound they make to the government, they have more incentive to spend a higher proportion of their time adjusting their financial affairs to avoid tax at the expense of time spent creating more wealth.

His policy of punitive taxation will have exactly the opposite effect. But actually there is an intelligent way for a government which understands incentives to get more tax from the richest people. But you don't do it by confiscatory high tax rates - quite the opposite.

Grateful to Fraser Nelson of the Speccie for sharing this chart which shows how the share of income tax paid by the richest 1% in Britain has been trending up - and jumped up after the top rate was cut from 50%. The left hand part of the line is under the last Labour government, the right hand part is under the Coalition and then the Conservatives.

And the truth, contrary to just about everything said on the subject these days by even "moderate" Labour politicians, is that the rich have been paying more income tax, and a higher share of income tax under both David Cameron and Theresa May than they ever did under Blair and Brown.

So this is how an intelligent government might try to squeeze the rich.

Cut tax RATES from confiscatory levels and the AMOUNT of tax, and the proportion, paid by the richest 1% goes UP.

The same thing happened even more dramatically after 1979 when Maggie cut the top rate from 98% (on so-called "unearned" income, and 83% on "earned" income) to 60% (and later to 40%).

It's not rocket science. If people can keep more than 50% of extra money they earn, they've got more incentive to increase their after-tax income by increasing the amount of wealth they create. But if people are paying half or more of every extra pound they make to the government, they have more incentive to spend a higher proportion of their time adjusting their financial affairs to avoid tax at the expense of time spent creating more wealth.

Comments